DNA Sequencing Market Overview

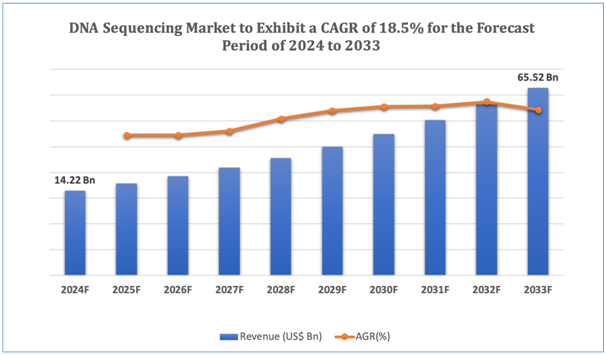

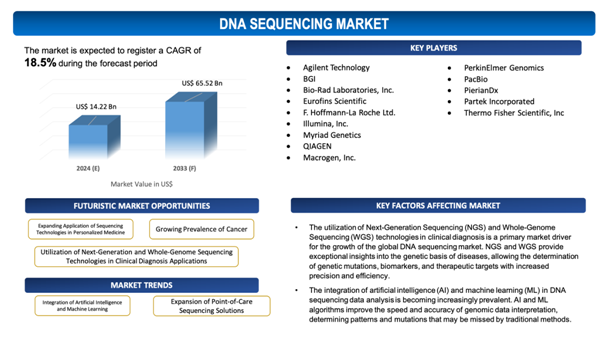

The global DNA sequencing market is estimated to be worth over USD 65.52 Bn in 2033 and is expected to grow at CAGR of18.5% during the forecast period (2024-2033).

DNA sequencing can be perceived as the process of identifying the accurate order of nucleotides within a DNA molecule. This technology has transformed biological research and medicine, enabling for the detailed analysis of genomes, which has been crucial in areas like evolutionary biology, genetics, and forensic science. Significant methodologies comprise Sanger sequencing, known for its precision, and next-generation sequencing (NGS), acknowledged for its high throughput and cost-effectiveness. NGS technologies, such as Illumina’s sequencing platforms, have dramaticallyminimized the cost and time needed for sequencing, supporting large-scale genomic projects like the Human Genome Project and personalized medicine initiatives.

The global DNA sequencing market has witnessedrobust growth owing to developments in technology, rising applications in clinical diagnostics, and growing investments in genomic research. Major factors driving the market growthcomprise the proliferating demand for precision medicine, advancements in cancer genomics, and the growing adoption of sequencing technologies in agriculture and biotechnology. North America currently holds the largest market share, fuelled by substantial R&D funding and the presence of key industry players. However, regions like Asia-Pacific are estimated to experience the swift growth attributing to rising healthcare infrastructure investments and governmental support for genomic research.

Leading companies in the DNA sequencing market include Illumina, Thermo Fisher Scientific, and Pacific Biosciences, all of which continue to innovate and enhance their product offerings. In addition to that, collaborations between academic institutions, research organizations, and industry players are fostering the development of new sequencing technologies and applications. As DNA sequencing becomes more integrated into research and clinical practice, its global market is anticipated for sustained growth, providingrevolutionary potential across various sectors.

Figure 1. DNA Sequencing: Market Size

Get more details on this report - Request Free Sample

Key Market Insights

The global DNA sequencing market is marked by swift advancements and considerable growth, fuelled by technological developments and expanding applications across different fields. Significant developments comprise the evolution of next-generation sequencing (NGS) technologies, which have drastically lowered the cost and enhanced the speed of sequencing, making large-scale genomic projects and personalized medicine more feasible.

Novel technologies are continuously emerging, such as nanopore sequencing by Oxford Nanopore Technologies, which provides portable, real-time sequencing capabilities, and single-molecule real-time (SMRT) sequencing by Pacific Biosciences, known for its long-read lengths and high accuracy. These developments are expanding the applications of DNA sequencing in clinical diagnostics, oncology, and infectious disease research, contributing to the increasing demand for precision medicine.

The market panorama is dominated by key players like Illumina, Thermo Fisher Scientific, and Pacific Biosciences, which are investing heavily in R&D and strategic partnerships to improve their sequencing platforms and expand their product portfolios. North America dominates the market, led by robust R&D investments, favorable regulatory policies, and the presence of key industry players. However, the Asia-Pacific region is estimated to witness the rapid growth owing to growing healthcare expenditure, government initiatives promoting genomic research, and growing awareness of precision medicine.

In summary, the global DNA sequencing market is poised for robust growth, fuelled by continuous technological advancements, expanding applications, and strategic industry collaborations, positioning it as a crucialelement of modern medical and scientific research.

Market Dynamics

Market Drivers

Utilization of Next-Generation and Whole-Genome Sequencing Technologies in Clinical Diagnosis Applications

The utilization of Next-Generation Sequencing (NGS) and Whole-Genome Sequencing (WGS) technologies in clinical diagnosis is a primary market driver for the growth of the global DNA sequencing market. NGS and WGS provideexceptional insights into the genetic basis of diseases, allowing the determination of genetic mutations, biomarkers, and therapeutic targets with increasedprecision and efficiency.

These technologies have transformed clinical diagnostics by supporting early detection, precision diagnosis, and personalized treatment plans for different conditions, specifically in oncology, genetic disorders, and infectious diseases.

The capability of NGS and WGS to offer comprehensive genomic information swiftly and cost-effectively has paved its way to their widespread adoption in clinical settings. For instance, in oncology, these technologies are used to profile tumours at a molecular level, steering targeted therapies and enhancing patient outcomes. In genetic disorders, WGS can determine rare mutations that are likely to not be detected by conventional methods, allowing precise diagnoses and better management of inherited conditions.

The growing integration of these technologies into routine clinical practice is fuelled by their proven clinical utility, falling costs, and supportive regulatory frameworks. As healthcare systems globally recognize the value of genomics in enhancing patient care, the demand for NGS and WGS in diagnostics continues to rise, accelerating the growth of the global DNA sequencing market.

Market Restraints

With regard to numerous advantages of DNA sequencing, the market faces several challenges due to the unique characteristics and requirements associated with these potent pharmaceutical products. Some of the key market challenges include:

- High Initial Costs and Infrastructure Requirements:Regardless of the declining costs of DNA sequencing over the years, the initial investment needed for acquiring advanced sequencing equipment and setting up the necessary infrastructure remains high. This comprises the cost of sequencing platforms, computational resources for data analysis, and specialized facilities to manage and store biological samples. These financial restraints can be particularly challenging for smaller research institutions and healthcare providers, impeding the widespread adoption of DNA sequencing technologies.

- Complexity of Data Interpretation and Lack of Skilled Professionals:The extensive amount of data generated by next-generation sequencing (NGS) and whole-genome sequencing (WGS) needs sophisticated bioinformatics tools and expertise to evaluate and interpret. There is a substantial shortage of professionals skilled in bioinformatics and genomic data analysis, which can deter the efficient utilization of sequencing data in clinical and research settings. In addition, the intricacy of genetic data interpretation poses challenges in ensuring accurate and clinically relevant insights, potentially hindering the adoption of these technologies in routine clinical practice.

Get more details on this report - Request Free Sample

Market Opportunity

Expanding Application of Sequencing Technologies in Personalized Medicine

Personalized medicine customizes medical treatment to the individual attributes of each patient, and DNA sequencing holds a critical role in this approach by offeringin-depth genetic insights that direct targeted therapies and interventions. The soaring understanding of the genetic basis of diseases, along with the diminishing cost of sequencing, has made it feasible to incorporate genomic data into routine clinical practice. This incorporationallows healthcare providers to offer more precise and effective treatments, enhancing patient outcomes and minimizingside effects.

Moreover, the surge of direct-to-consumer genetic testing services presents a growing market segment. Companies like 23andMe and Ancestry have simplified personal genomics, increasing public awareness and interest in genetic information. This trend is likely to boost demand for DNA sequencing services as more individuals seek to understand their genetic makeup for health, ancestry, and lifestyle purposes.

Furthermore, developments in sequencing technologies, such as real-time sequencing and portable devices, are augmenting the accessibility and convenience of genomic data acquisition. These innovations open new prospects for research, diagnostics, and therapeutic applications, positioning the DNA sequencing market for significant growth as it becomes critical to personalized healthcare solutions.

Market Trends

- Integration of Artificial Intelligence and Machine Learning:The integration of artificial intelligence (AI) and machine learning (ML) in DNA sequencing data analysis is becoming increasingly prevalent. AI and ML algorithms improve the speed and accuracy of genomic data interpretation, determining patterns and mutations that may be missed by traditional methods. This integration enables for more precise diagnostics and personalized treatment plans. In addition, AI-driven platforms are enhancing the scalability and efficiency of sequencing workflows, minimizing turnaround times and operational costs, which is propelling wider adoption in clinical and research settings.

- Expansion of Point-of-Care Sequencing Solutions:The development and adoption of portable, point-of-care (POC) sequencing devices represent a soaring trend in the DNA sequencing market. Technologies like Oxford Nanopore’s MinION allow real-time, on-site genomic analysis, making DNA sequencing more accessible in diverse settings, comprising remote and resource-limited areas. These portable solutions are specifically beneficial for applications in infectious disease diagnostics, outbreak tracking, and personalized medicine, where swift and accurate genomic information is critical. The expansion of POC sequencing is poised to democratize access to advanced genomic technologies, further propelling market growth and widening the scope of DNA sequencing applications.

DNA Sequencing Market: Key Segments

By Product & Services

- Consumables

- Instruments

- Services

By Technology

- Sanger Sequencing

- Next-Generation Sequencing

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- Targeted Sequencing & Resequencing

- Third Generation DNA Sequencing

- Single-Molecule Real-Time Sequencing (SMRT)

- Nanopore Sequencing

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

By Application

- Oncology

- Reproductive Health

- Clinical Investigation

- Agrigenomics & Forensics

- HLA Typing/Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Consumer Genomics

- Others

By End-Use

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Other Users

By Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- South America

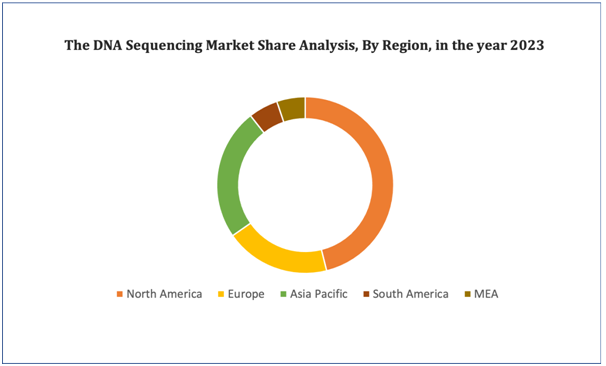

Figure 4. DNA Sequencing Market: Distribution by Region

Get more details on this report - Request Free Sample

DNA Sequencing Market: Regional Analysis

North America dominated the market with a revenue share of 50.70% in 2023. The significant adoption of DNA sequencing technology and the presence of several major players like Thermo Fisher Scientific, Inc., Oxford Nanopore Technologies plc, Illumina, Inc., are fuelling the market growth in this region. Furthermore, the players operating in the U.S. are undertaking several strategic initiatives to strengthen their market presence in the country, supporting regional expansion.

Leading DNA Sequencing Developers

Industry Trends and Global Forecasts, 2023-2035 report features an extensive study of the current market landscape, market size and future opportunities associated with the DNA sequencingmarket, during the given forecast period. Further, the market report highlights the efforts of several stakeholders engaged in this rapidly emerging segment of the biopharmaceutical industry. Key takeaways of the DNA Sequencingmarket are briefly discussed below.

The report includes the list of players operating in the global DNA sequencing market. Some of the key players include:

- Agilent Technology

- BGI

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- Myriad Genetics

- QIAGEN

- Macrogen, Inc.

- PerkinElmer Genomics

- PacBio

- PierianDx

- Partek Incorporated

- Thermo Fisher Scientific, Inc

DNA Sequencing Market: Key Developments

- In November 2023, Illumina Inc., a global leader in DNA sequencing and array-based technologies, announced the launch of the Global Health Access Initiative to support access to pathogen sequencing tools for public health in

low- and middle-income countries (LMICs).

- In August 2023, PacBio entered into an agreement to acquire Apton Biosystems. This acquisition is anticipated to accelerate the development of Short-read Sequencer, propelling the market growth.

Scope of the Report

The market report presents an in-depth analysis of the various firms / organizations that are engaged in this market, across different segments, as defined in the below table:

|

|

Key Report Attributes |

Details |

||

|

|

Base Year |

2023 |

||

|

|

Forecast Period |

2024-2033 |

||

|

|

CAGR (2024-2033) |

18.5% |

||

|

|

Product & Services |

|

||

|

|

Technology |

|

||

|

|

Workflow |

|

||

|

|

Application |

|

||

|

|

End-Use |

|

||

|

|

Key Geographical Regions |

|

||

|

Key Companies Profiled |

|

|

||