Epilepsy is a heterogeneous condition requiring individualized treatment based largely on a patient’s seizure syndrome and seizure type. According to the American association of neurological surgeons, epilepsy therapeutics are significantly effective and completely control seizures in a majority (approximately 78%) of patients.

Market Size & Growth Rate:

The epilepsy treatment market was valued at USD 10.9 billion in 2021 and is expected to reach USD 14.6 billion by 2027, exhibiting a CAGR of 5.2% during the forecast period 2022-2027. Due to a surge in the prevalence of neurological disorders among epilepsy diseases, increases in innovative medicines & extensive research of epilepsy therapeutics around the globe, and a rise in the adoption of therapeutics by patients.

Market Dynamics:

It is one of the most common neurological disorders worldwide, affecting people of all ages. Presently, nearly 50 million patients are living with epilepsy worldwide, and about 2.4 million cases are diagnosed annually. In addition, epilepsy is estimated to affect 49 people out of every 100,000 in developed countries each year and it can reach 139 per 100,000 in developing countries, and 70% of people can live a seizure-free life if epilepsy is properly diagnosed and treated.

However, the WHO program on decreasing the epilepsy treatment gap and the mental health Gap Action Programme (mhGAP) reached these projects in developing countries such as Myanmar, Ghana, Mozambique, and Viet Nam. These projects focused on expanding the skills of primary care and non-specialist healthcare providers at the community level to diagnose, treat, and awareness of the people associated with epilepsy.

According to the Australian department of health report, February 2021, the Australian government is investing USD 100 million into the development of new technologies to improve the diagnosis and treatment of epilepsy, lung disease and it is positively reflecting the anti-epileptic drugs market growth.

| Report Coverage | Details |

|---|---|

| Base Year | 2023 |

| Market Size in 2023 | USD 10.2 Million |

| CAGR (2024-2031) | 5.5% |

| Forecast Years | 2024-2031 |

| Historical Data | 2016-2022 |

| Market Size in | USD 5.5 Million |

| companies Covered | Pfizer, UCB S.A., Bausch Health Companies Inc, Novartis AG, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Johnson & Johnson Services Inc., NeuroPace Inc., Sunovion Pharmaceuticals Inc., Eisai Co., Upsher-Smith Laboratories, Amneal Pharmaceuticals LLC., Sanofi S.A., NeuroWave Systems Inc., Natus Medical Incorporated., Siemens Ltd. |

| Segments Covered | By Product, By Distribution Channel, By Region |

| Challenges |

|

Get more details on this report - Request Free Sample

Market Drivers:

- Collaboration and acquisitions are boosting market growth.

Acquisitions & agreements of competitors to rise at a promising growth rate in the epilepsy therapeutic market, for instance,- In July 2022, Eysz, Inc. collaborated with various organizations such as the University of California, San Francisco (UCSF), University of California San Diego Rady Children’s Hospital (RADYs), Children’s Hospital of Orange County (CHOC) to introduce a new diagnostic tool, which is a patented seizure detection algorithm through passive analysis of eye-movement data.

- In February 2021, Koninklijke Philips N.V acquired BioTelemetry, through which koninklijke healthcare increases its services network for its epilepsy therapeutics market

- In August 2021, an agreement was signed between Yuyu Pharma and Novartis Korea, through which Yuyu obtained significant distribution rights for three prescription drugs, including Tegretol, a medication used to treat diseases including epilepsy.

- In January 2020, Neurelis received FDA approvals for Valtoco (diazepam nasal spray) in frequent seizure activity (i.e., seizure clusters, acute repetitive seizures) that are distinct from a patient’s usual seizure pattern in people with epilepsy 6 years of age and older

- Continuous innovations and developments in the field of the epilepsy therapeutics industry.

- Brain tumours are the second most common cause of epilepsy in the geriatric population.

- Increasing incidences of neurological disorders are expected to fuel the prevalence.

Challenges:

- The shortage of neurology healthcare professionals in many developing nations.

- According to the American Academy of Neurology (AAN), the gap between demand for and supply of neurologic services is expanding due to several factors, including an aging population increasingly afflicted with neurodegenerative disorders and in some regions, prolonged patient wait times are among the most apparent, and neurologists choosing to practice subspecialties that are not among those most urgently required. Current data in adult neurology are not available, but reports agree that wait times are excessive.

- The high cost and restricted prescription limit the accessibility to ant seizure medications.

- Lack of awareness of epilepsy in developing nations.

Competitive landscape:

Pfizer, UCB S.A., Bausch Health Companies Inc, Novartis AG, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd., Johnson & Johnson Services Inc., NeuroPace Inc., Sunovion Pharmaceuticals Inc., Eisai Co., Upsher-Smith Laboratories, Amneal Pharmaceuticals LLC., Sanofi S.A., NeuroWave Systems Inc., Natus Medical Incorporated., Siemens Ltd. and Others.

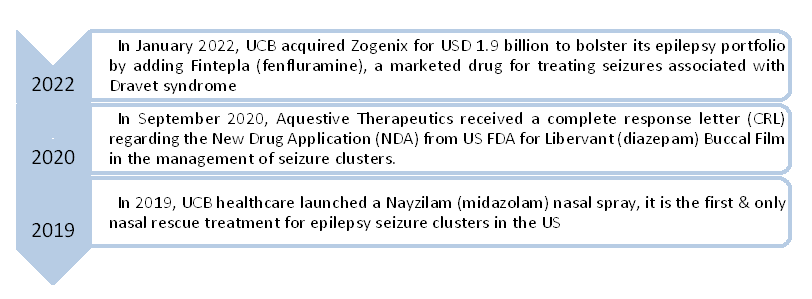

Key Developments:

Get more details on this report - Request Free Sample

Regional Analysis:

North America holds a key share of the global epilepsy therapeutics market in forecast periods. Extensive research on various generations of AEDs has propelled revenue prospects. The market has also noted new revenue streams through public education and awareness of the economic and health burden of epilepsy. For instance,

- In November 2021, In the US, November is celebrated annually as National Epilepsy Awareness Month (NEAM).

- Every year, the Epilepsy Foundation launches the #RemoveTheFilter social media campaign to minimize fear about epilepsy issues and bring hope to those facing challenges

The U.S. accounted for a major share of the regional market. Advancements in diagnostic technologies lead to better identification of epilepsy syndrome, including rare and severe forms of epilepsy, reiterating ongoing epilepsy therapeutics market trends. In addition, the significance of key players, some of the best research universities, and an encouraging start-up ecosystem provide an ideal environment for research leading to more successful assets in the healthcare deportment.

- In 2019, Teva Pharmaceutical Industries Ltd. launched its new advanced product of a generic version of Sabril (Vigabatrin). It is the first generic version of Sabril (vigabatrin) tablets to enter the U.S. market

Europe also holds a substantial share of the epilepsy therapeutic market. This can be expected to propel even more owing factors such as the rise in the generic population, reimbursements, and strategic alliances for healthcare facilities and technological research in the epilepsy therapeutics market.

- In 2019, SK Biopharmaceuticals entered into an exclusive licensing agreement with Arvelle Therapeutics to develop and commercialize Cenobamate in Europe

- Increasing R&D investment and the launch of new formulations are further anticipated to fuel the growth like UCB Biopharma has developed Briviact to treat Partial-Onset (Focal) Seizures in Paediatric Epilepsy Patients.

Furthermore, rising awareness levels about epilepsy are also anticipated to stimulate market growth.

Asia Pacific's epilepsy therapeutics market is anticipated to rise at a promising growth rate in the next few years. A substantial advancement in medical infrastructure, along with growing awareness about the impacts of epilepsy on the quality of life of the affected, is boosting the prospects. Moreover, macro-economic factors such as large population and growing economy, speed prevalence of epilepsy, and increasing investments to drive market access in key markets such as Japan, China, Australia, Singapore, and India.

- February 2021, Dr. Reddy's Laboratories received approval from the United States FDA for the drug Vigabatrin as an antiepileptic product across the US market.

- In March 2021, India-based Alkem Laboratories launched the Brivasure product for treating epilepsy in India.

- In February 2021, Sun Pharmaceutical Industries announced the introduction of a complete range of anti-epilepsy drugs, including Brivaracetam, in India at an affordable price.

- In March 2019, the Zogenix company entered into a significant distribution agreement with Nippon Shinyaku to support the sales and distribution of the Fintepla product in Japan.

Healthcare including the epilepsy market in the Middle East is gaining significant progress on account of various factors including government initiatives to encourage medical tourism, evolving health insurance policies, and growing propensity among the local population to consume digital health services. The epilepsy therapeutic market is primarily dominated by five countries such as Saudi Arabia, Iran, Israel, Egypt, and UAE. Moreover, all together cover more than 85% of the Middle East healthcare market.

Latin America will contribute to the poor growth epilepsy market, in addition, a lack of approved treatment options may lead to the slow growth of the epilepsy market. However, from the initiates by many government & health ministries, pharmaceutical companies, and NGOs conduct health programs and camps to educate the people and raise awareness to the market players distributing free samples and products for educating the people and promoting their drugs is anticipated to propel the epilepsy Market during the forecast years.

Pipeline:

The epilepsy pipeline landscape is evolving with increased insight into significant biological pathways and mechanisms underlying epilepsy, leading to further targeting and pipeline therapies in various stages of clinical development, key companies are working to improve the pipeline space and future growth potential of the epilepsy pipeline platform. For instance,

- In January 2021, Addex Therapeutics announced that its partner Janssen Pharmaceuticals had received FDA’s Investigational New Drug (IND) approval to begin a Phase2 with the significant metabotropic glutamate type2 (mGlu2) receptor positive allosteric modulator (PAM), JNJ-40411813 (ADX71149), in patients with epilepsy

- In November 2020, Biogen announced a report on the phase-2 clinical data of Natalizumab and its significant action as a humanized monoclonal antibody against the cell adhesion molecule α4-integrin

- In October 2020, PTC Therapeutics announced the initiation of a registration-directed Phase II/III clinical trial to evaluate vatiquinone (PTC743) in patients with mitochondrial epilepsy, the highly morbid condition of refractory seizures in children

- In December 2020, Expesicor Inc. initiated a preclinical study of new drug development (EXP-119) with a biological mechanism of action

- In October 2019, FYR Diagnostics received a grant from the national institutes of health to advance epilepsy diagnostic tests. The grant has the potential to provide a total of USD 618,086 in nondilutive financing.

- In September 2019, Stoke Therapeutics sponsored the new drug in the preclinical phase development of STK-001. Currently (December 2021) in phase 1/2a study of STK-001 in children and adolescents with dravet Syndrome.

Market Segments:

- The global Epilepsy therapeutics market estimates (Value USD Million) & Forecasts and Trend Analyses, 2022 to 2027 based on Product

- First Generation Epilepsy therapeutics

- Second Generation Epilepsy therapeutics

- Third Generation Epilepsy therapeutics

- The global Epilepsy therapeutics market estimates (Value USD Million) & Forecasts and Trend Analyses, 2022 to 2027 based on Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy.

What is the Epilepsy therapeutic Market Report about?

The epilepsy therapeutics market report discusses the commercial and clinical activity associated with applications. It provides insights on the total size of the potential opportunity, key segments driving growth, key challenges faced, and a thorough analysis of market competition by product, geography, indication, and forecasts through 2027. Detailed coverage of the approved epilepsy therapeutics, including regulatory approvals, pricing, reimbursement, and market penetration. So, a new investor can potentially gain information about epilepsy therapeutic companies, their key products, their core strategy, key trends in the epilepsy therapeutic market, and more.

The epilepsy therapeutic market report is essential for all stakeholders including research companies, manufacturing companies, distribution companies, government agencies, and others.

- Capitalize on rapidly emerging trends

- Optimize decision-making

- Reduce company risk

- Approach partners/investors for collaboration or funding

- Implement an informed and advantageous business strategy in 2022

- Detailed coverage of the approved nuclear medicine therapeutics, including regulatory approvals, pricing, reimbursement, and market penetration

- Profiles of leading & upcoming epilepsy therapeutics competitors composing the global marketplace