India Medical Clothing Market Overview

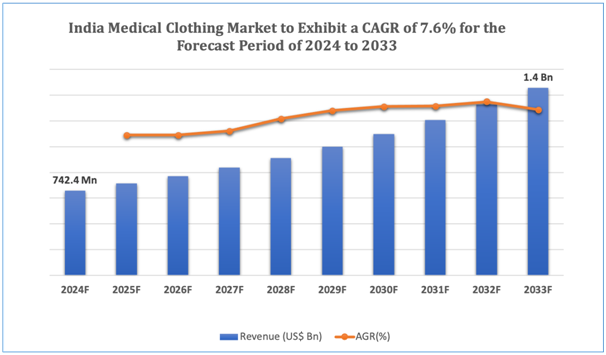

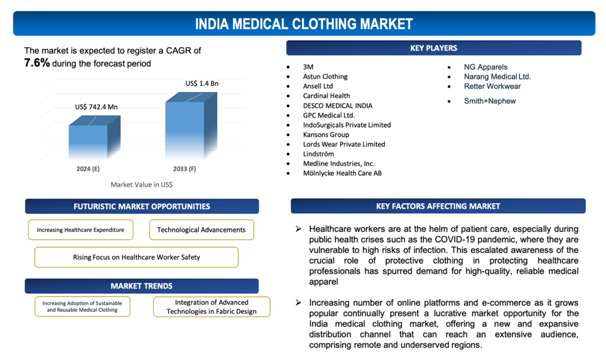

The India medical clothing market is estimated to be worth over USD 1.4Bn in 2033 and is expected to grow at CAGR of7.6% during the forecast period (2024-2033).

The India medical clothing market has experienced anotable transformation in recent times, fuelled by the soaring awareness of healthcare hygiene, the expansion of healthcare infrastructure, and the impact of the COVID-19 pandemic. The pandemic, in particular, played a catalytic role, focusing on the significance of personal protective equipment (PPE) and medical clothing in protecting healthcare professionals and patients. This pave its way to a rise in demand for medical clothing, comprising8 surgical gowns, scrubs, masks, and gloves, encouraging manufacturers to build-up production and innovate with new materials and designs.

One of the major factors contributing to the market's revolution is the higher focus on infection control and patient safety. With the growing incidence of hospital-acquired infections, there has been an increasing demand for high-quality, disposable medical clothing that fulfils international standards. This has fueled advancements in fabric technology, resulting in the development of antimicrobial, fluid-resistant, and breathable materials that improve protection and comfort.

The expansion of healthcare facilities across India, especially in Tier II and Tier III cities, has also held a critical role in the growth of the medical clothing market. As more hospitals and clinics are established, the necessity for standardized and reliable medical apparel has surged, further propelling market demand.

In addition, the Indian government's initiatives to strengthen the domestic manufacturing sector, such as the "Make in India" campaign, have spurred local production of medical clothing. This has not only minimized dependency on imports but also positioned India as a leading player in the global medical textile industry.

All in all, the India medical clothing market has modifiedswiftly, led by escalated healthcare awareness, technological innovations, and greater domestic manufacturing, positioning it for sustained growth and innovation in the forthcoming years.

Figure 1. India Medical Clothing : Market Size

Get more details on this report - Request Free Sample

Key Market Insights

The India medical clothing market is swiftlydeveloping, indicating the extensive changes in the country’s healthcare sector. Latest market insights reflect that there is a increasing focus on hygiene, safety, and infection control, which has driven the demand for high-quality medical apparel. The COVID-19 pandemic substantially accelerated this demand, with an escalated emphasis on personal protective equipment (PPE) such as masks, gloves, surgical gowns, and scrubs.

One of the significant developments in the market is the rise in domestic manufacturing, spurred by government initiatives like "Make in India" and the Production Linked Incentive (PLI) scheme. These policies have encouraged local production, minimizing dependence on imports and positioning India as a major supplier in the global medical textile industry. In addition, there has been significant investment in research and development to create advanced materials that provideimproved protection, such as antimicrobial, fluid-resistant, and breathable fabrics.

Novel technologies are also defining the market, with innovations in fabric engineering resulting in the development of durable, reusable, and comfortable medical clothing. Integration of smart textiles, which can monitor body temperature and other vital signs, is an emerging trend that could revisit the functionality of medical apparel.

The current market landscape is marked by intense competition among both domestic and international players, with an emphasis on product innovation, quality enhancement, and cost-effectiveness. As healthcare infrastructure continues to expand across urban and rural areas, the Indian medical clothing market is poised for continued growth, driven by the need for reliable and innovative medical apparel solutions.

Market Dynamics

Market Drivers

Rising Focus on Healthcare Worker Safety

Increasing focus on healthcare worker safety has emerged as a primary market driver for the India medical clothing market. Healthcare workers are at the helm of patient care, especially during public health crises such as the COVID-19 pandemic, where they are vulnerable to high risks of infection. This escalated awareness of the crucial role of protective clothing in protecting healthcare professionals has spurred demand for high-quality, reliable medical apparel. The prominence of ensuring the safety and well-being of healthcare workers has paved its way to stringent regulations and guidelines, which mandate the use of personal protective equipment (PPE) in hospitals and other healthcare settings.

The Indian market has responded with a rise in the production and innovation of medical clothing designed to fulfil these safety standards. Manufacturers are progressivelyemphasizing on developing advanced protective gear, such as surgical gowns, masks, gloves, and coveralls, made from materials that offer better resistance to pathogens, fluids, and chemicals. The focus is not only on protection but also on comfort and usability, ensuring that healthcare workers can wear this clothing for extended periods without discomfort.

Moreover, the government and private healthcare institutions have made notable investments in ensuring adequate supplies of medical clothing, reinforcing the market's growth. The higher focus on safety has also spurred the adoption of disposable medical apparel, minimizing the risk of cross-contamination between patients and healthcare workers. As awareness of occupational hazards in healthcare continues to surge, the demand for protective medical clothing is expected to remain a leading growth driver in the Indian market, ensuring that healthcare workers are better protected and able to perform their duties safely.

Market Restraints

With regard to numerous advantages of India medical clothing, the market faces several challenges due to the unique characteristics and requirements associated with these potent pharmaceutical products. Some of the key market challenges include:

- High Production Costs: The cost of producing high-quality medical clothing, particularly those integrating advanced materials like antimicrobial or fluid-resistant fabrics, can be substantially higher. This can deter the affordability and accessibility of such products, especially in smaller healthcare facilities and rural areas, hampering market growth.

- Inconsistent Regulatory Compliance: Regardless oftheincreasingfocus on healthcare safety, inconsistent enforcement of regulations and standards across various regions in India can hamper the uniform adoption of medical clothing. This inconsistency can result in variability in product quality and safety, affecting the overall growth and reliability of the market.

Get more details on this report - Request Free Sample

Market Opportunity

Rising Online Platforms and E-Commerce

Increasing number of online platforms and e-commerce as it grows popular continually present a lucrative market opportunity for the India medical clothing market, offering a new and expansive distribution channel that can reach an extensive audience, comprising remote and underserved regions. The shift towards digitalization in India, along with the growing penetration of the internet and smartphones, has made online shopping more accessible and convenient for both individual consumers and healthcare institutions. This trend has been further boosted by the COVID-19 pandemic, which highlighted the prominence of contactless transactions and home deliveries, making e-commerce a preferred mode of purchase for medical supplies, including clothing.

Online platforms enable manufacturers and suppliers to showcase a wide range of medical clothing products, from basic PPE to specialized apparel, offering detailed product descriptions, certifications, and customer reviews. This transparency helps buyers make informed decisions and compare products easily, which is especiallybeneficial for small and medium-sized healthcare providers who are likely to lack access to large-scale procurement channels.

Moreover, e-commerce platforms often offer competitive pricing, bulk purchasing options, and quick delivery services, making it easier for healthcare facilities to maintain sufficient supplies of medical clothing. The convenience of ordering online, combined with the ability to track shipments and manage inventory through digital tools, enhances operational efficiency for healthcare providers.

Market Trends

- Increasing Adoption of Sustainable and Reusable Medical Clothing: With growing environmental concerns, there is a soaring trend towards sustainable and eco-friendly medical clothing. Healthcare providers are progressively opting for reusable garments made from durable, high-quality materials that can withstand multiple washes and sterilizations. This shift not only minimizes waste but also offers cost savings over time, contributing to the adoption of more sustainable practices within the industry.

- Integration of Advanced Technologies in Fabric Design: The integration of advanced technologies, such as antimicrobial treatments and smart textiles, is becoming a significant trend in the India medical clothing market. These innovations enhance the protective capabilities of medical garments by offering features like bacteria-resistant surfaces and embedded sensors that monitor vital signs. This trend is driven by the need for higher safety standards and improved functionality in healthcare settings.

India Medical Clothing Market: Key Segments

By Product

- Professional Apparel

- Patient Apparel

- Specialty Apparel

- First Aid Clothing

- Wraps and Towels

- Others

By Usage

- Reusable

- Disposable

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Centres

- Home Care Settings

- Research and Clinical Laboratories

- Others

By Distribution Channel

- Direct Tender

- Retail Sales

- Third Party Distributor

- Others

India Medical Clothing Market: Regional Analysis

The Indian medical clothing market is experiencing robust growth, driven by the expansion of healthcare infrastructure, increased focus on hygiene, and government initiatives promoting local manufacturing. The market is highly fragmented, with both domestic and international players contributing to the supply of medical apparel. Urban centers, particularly in Tier I cities, lead in demand due to the concentration of advanced healthcare facilities, while rural and Tier II regions are witnessing growing adoption as healthcare services expand. Government regulations and the "Make in India" campaign are further supporting market development.

Leading India Medical Clothing Developers

Industry Trends and Global Forecasts, 2023-2035 report features an extensive study of the current market landscape, market size and future opportunities associated with the India Medical Clothing market, during the given forecast period. Further, the market report highlights the efforts of several stakeholders engaged in this rapidly emerging segment of the biopharmaceutical industry. Key takeaways of the India Medical Clothing market are briefly discussed below.

The report includes the list of players operating in the India medical clothing market. Some of the key players include:

- 3M

- Astun Clothing

- Ansell Ltd

- Cardinal Health

- DESCO MEDICAL INDIA

- GPC Medical Ltd.

- IndoSurgicals Private Limited

- Kansons Group

- Lords Wear Private Limited

- Lindström

- Medline Industries, Inc.

- Mölnlycke Health Care AB

- NG Apparels

- Narang Medical Ltd.

- Retter Workwear

- Smith+Nephew

India Medical Clothing Market: Key Developments

- In November 2023, Lindströminaugurateda new workwear unit in North India. The unit is situated in the city of Faridabad, which is part of the Delhi capital region. Spread over 5,500 square meters, its capacity can be doubled to service 600,000 pieces of workwear monthly.

Scope of the Report

The market report presents an in-depth analysis of the various firms/organizations that are engaged in this market, across different segments, as defined in the below table:

|

|

Key Report Attributes |

Details |

||

|

|

Base Year |

2023 |

||

|

|

Forecast Period |

2024-2033 |

||

|

|

CAGR (2024-2033) |

7.6% |

||

|

|

Product |

|

||

|

|

Usage |

|

||

|

|

End User |

|

||

|

|

Distribution Channel |

|

||

|

Key Companies Profiled |

|

|

||