Sterile Medical Packaging Market Overview

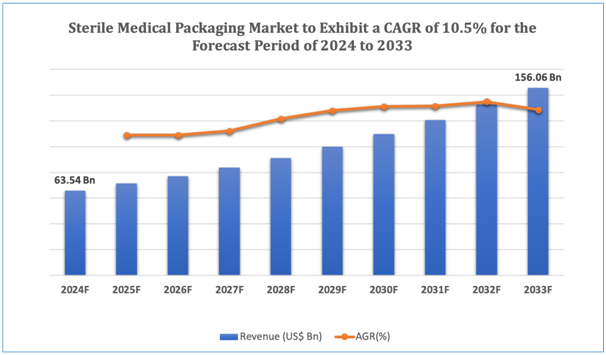

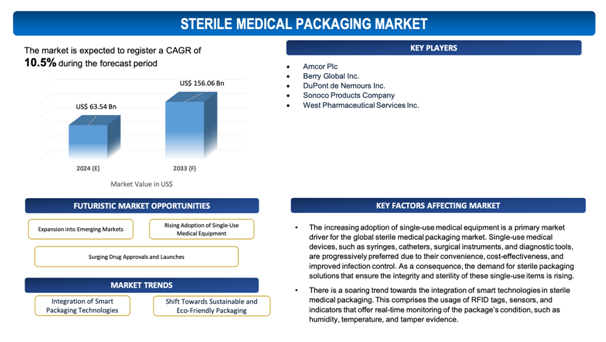

The global sterile medical packaging market is estimated to be worth over USD 156.06Bn in 2033 and is expected to grow at CAGR of10.5% during the forecast period (2024-2033).

Sterile medical packaging holds a critical role in ensuring the efficacy, safety, and longevity of pharmaceutical products. Composed to maintain sterility, it avoids contamination by microorganisms and protects against environmental factors such as oxygen, moisture, and light. Materials generally used comprise medical-grade paper, high-barrier films, and specialized plastics, all customized to fulfil stringent regulatory standards. This type of packaging is crucial for an extensive scale of products, comprising surgical instruments, syringes, implants, and diverse drug formulations, particularly those used in hospitals and other healthcare settings.

The revolution of the pharmaceutical outlook through sterile medical packaging is profound. One of the major drivers is the growing prevalence of chronic diseases and the soaring need for biologics and injectables, which need stringent sterility standards. Advanced packaging solutions, such as pre-filled syringes and single-use systems, improve patient safety and convenience while minimizing the risk of contamination and medication errors. In addition, the emergence of smart packaging technologies, which integrate sensors and indicators, enables for real-time monitoring of integrity and sterility, ensuring that pharmaceuticals are maintained under optimal conditions throughout the supply chain.

Sustainability is also a notable trend defining the sterile medical packaging market. There is increasing demand for environment-friendly and recyclable materials that do not jeopardize on sterility or performance. Advancements in biodegradable plastics and renewable resources are gaining momentum, streamlining with global sustainability goals and mitigating the environmental impact of medical waste.

Moreover, the push for personalized medicine is accelerating the development of tailored packaging solutions that cater to specific patient needs and drug formulations. Personalized packaging not only improves drug stability and safety but also enhances patient adherence and outcomes.

Therefore, sterile medical packaging is a crucialelement in the pharmaceutical industry, transforming it through improved safety, technological advancements, and aemphasis on sustainability. It ensures the delivery of effective, safe, and environmentally responsible healthcare solutions, fulfilling the evolving demands of modern medicine.

Figure 1. Sterile Medical Packaging : Market Size

Get more details on this report - Request Free Sample

Key Market Insights

The global sterile medical packaging market is witnessingstrong growth, fuelled by growing demand for infection control and the increasing prevalence of chronic diseases. Latest market insights reveal a notable shift towards advanced packaging solutions that ensure sterility and improve patient safety. High-barrier films, medical-grade paper, and specialized plastics are prominently used to protect products from contamination and environmental factors. The market is characterized by stringent regulatory standards, requiringuninterrupted innovation and compliance efforts by manufacturers.

Significant developments in the market comprise the adoption of smart packaging technologies. These innovations integrate sensors and indicators that monitor temperature,sterility, and integrity in real-time, ensuring that pharmaceuticals are maintained under optimal conditions throughout the supply chain. Additionally, the surge of pre-filled syringes and single-use systems is notable, providing improved convenience and minimized risk of contamination and medication errors.

Sustainability is a critical trend shaping the market landscape. There is a growing emphasis on environment-friendly and recyclable materials, with companies investing in biodegradable plastics and renewable resources to meet regulatory demands and consumer expectations for greener solutions. This shift streamlines with global sustainability goals and acknowledges the environmental impact of medical waste.

In addition to that, the customization of packaging solutions to cater to specific drug formulations and patient needs is gaining traction. Personalized medicine, particularly biologics and injectables, demands specialized packaging that ensures product integrity and patient safety.

Therefore, the global sterile medical packaging market is evolving rapidly, driven by technological advancements, regulatory requirements, and a focus on sustainability. These factors are reshaping the market, offering new opportunities for innovation and growth while ensuring the highest standards of efficacy and safety inpharmaceutical products.

Market Dynamics

Market Drivers

Rising Adoption of Single-Use Medical Equipment

The increasing adoption of single-use medical equipment is a primary market driver for the global sterile medical packaging market. Single-use medical devices, such as syringes, catheters, surgical instruments, and diagnostic tools, are progressively preferred due to their convenience, cost-effectiveness, and improved infection control. These devices eradicate the need for sterilization and reprocessing, minimizing the risk of cross-contamination and healthcare-related infections. As a consequence, the demand for sterile packaging solutions that ensure the integrity and sterility of these single-use items is rising.

This trend is driven by several factors, comprising stringent regulatory standards aimed at minimizing infection risks and enhancing patient safety. Healthcare facilities are under pressure to comply with these regulations, resultingin a greaterintake of single-use medical equipment. In addition, the continuous COVID-19 pandemic has further underscored the prominence of infection prevention, boosting the move towards disposable medical devices and the necessity for reliable sterile packaging.

Technological developments in materials and packaging methods are also contributing to this market growth. Advancements such as high-barrier films, sterilization indicators, and tamper-evident features are being incorporated into sterile packaging to ensure optimal protection and ease of use. These innovations not only improve the efficacy and safety of single-use medical devices but also provide healthcare professionals with the assurance of sterility up to the time of use.

Overall, the increasing adoption of single-use medical equipment is fuelling the demand for advanced sterile medical packaging solutions. This trend, boosted by regulatory requirements, infection control priorities, and technological innovations, is transforming the sterile packaging market, ensuring the delivery of safe and effective healthcare solutions.

Market Restraints

With regard to numerous advantages of Sterile Medical Packaging , the market faces several challenges due to the unique characteristics and requirements associated with these potent pharmaceutical products. Some of the key market challenges include:

- High Production Costs and Complexity: The production of advanced sterile medical packaging requires specialized materials and technologies, resulting in high manufacturing costs. This financial strain can be especiallycomplicated for small and medium-sized enterprises (SMEs) in the pharmaceutical and medical device sectors. In addition, the intricacy involved in ensuring consistent quality and sterility standards across different products adds to the operational challenges, potentially deterring market expansion and innovation.

- Stringent Regulatory Requirements: The sterile medical packaging market is subject to rigorous regulatory standards and compliance requirements across different regions. Navigating these intricate regulations can be time-consuming and costly for manufacturers, impacting their ability to swiftly bring novel products to market. Frequent updates and variations in regulatory frameworks between countries add further complexities, requiring continuous investment in compliance and quality assurance processes, which can stretch resources and impede market growth.

Get more details on this report - Request Free Sample

Market Opportunity

Expansion into Emerging Markets

Expansion into emerging markets stands as a major opportunity for the global sterile medical packaging market. Emerging economies, especially in Asia, Latin America, and Africa, are witnessingswift growth in their healthcare sectors attributing to growing investments, enhancing healthcare infrastructure, and increasing awareness of healthcare standards. These regions have a soaring demand for high-quality medical products, fuelled by an increasing middle class, heightened health insurance coverage, and government initiatives to improve public health.

The proliferating population in these markets, coupled with a greater incidence of chronic diseases and a necessity for enhanced healthcare services, requires the availability of reliable and safe medical products. This creates a strong demand for sterile medical packaging, which ensures the integrity and sterility of pharmaceuticals and medical devices. Companies that strategically expand into these regions can penetrate new customer demographics and achieve significant market growth.

Additionally, the cost benefits of manufacturing in emerging markets can pave its way to minimized production expenses, allowing companies to offer competitive pricing while maintaining high-quality standards. Collaborations with local manufacturers and suppliers can also improve market entry and expansion, fostering innovation and adaptation to local market needs.

Furthermore, emerging markets often have less stringent regulatory environments compared to developed regions, offering a more favourable outlook for the introduction of new products. However, as these markets continue to develop, their regulatory standards are anticipated to tighten, streamlining with global benchmarks, which will further drive the demand for compliant and advanced sterile packaging solutions.

Thus, the expansion into emerging markets offers a lucrative opportunity for the global sterile medical packaging market, fuelled by increasing healthcare needs, favourable economic conditions, and the potential for cost-effective production and innovation.Top of Form

Bottom of Form

Market Trends

- Integration of Smart Packaging Technologies: There is a soaring trend towards the integration of smart technologies in sterile medical packaging. This comprises the usage of RFID tags, sensors, and indicators that offer real-time monitoring of the package’s condition, such as humidity, temperature, and tamper evidence. These developmentsimprove the safety and traceability of medical products, ensuring they are stored and transported under optimal conditions, thusenhancing patient safety and regulatory compliance.

- Shift Towards Sustainable and Eco-Friendly Packaging: Sustainability is becoming a primary focus in the sterile medical packaging market. There is a growing demand for packaging solutions that are eco-friendly, such as compostable, biodegradable, and recyclable materials. Companies are investing in green technologies and materials that minimize the environmental impact without compromising on the sterility and protection of medical products. This trend is fuelled by both regulatory pressures and consumer demand for sustainable healthcare solutions.

Sterile Medical Packaging Market: Key Segments

By Material

- Plastic

- Metal

- Paper &Paperboard

- Glass

- Others (Rubber)

By Type

- Thermoform Trays

- Sterile Bottles &Containers

- Pre-fillable Inhalers

- Vial & ampoule

- Pre-filled Syringes

- Sterile Closures

- Blister & Clamshells

- Bags & Pouches

- Wraps

- Others (Strip Packs)

By Sterilization Method

- Chemical Sterilization

- Radiation Sterilization

- High Temperature/Pressure Sterilization

By Application

- Pharmaceutical & Biological

- Surgical & Medical Instruments

- In Vitro Diagnostic Products

- Medical Implants

- Others (Surgical Supplies)

By Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- South America

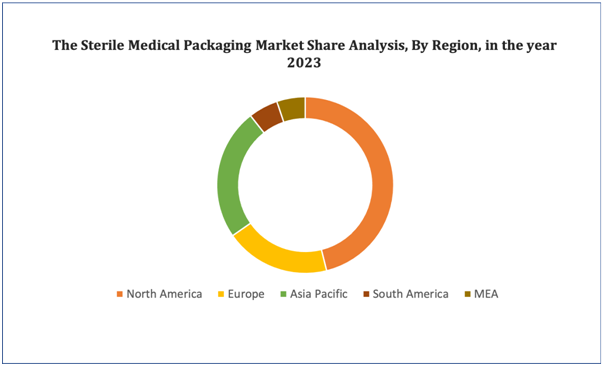

Figure 4. Sterile Medical Packaging Market: Distribution by Region

Get more details on this report - Request Free Sample

Sterile Medical Packaging Market: Regional Analysis

North America is estimated to account for the highest CAGR in the global sterile medical packaging market due to advanced healthcare infrastructure, significant R&D investments, and stringent regulatory standards. The region's focus on innovation and sustainability in medical packaging, coupled with a growing aging population and high prevalence of chronic diseases, drives demand for sterile packaging solutions.

Leading Sterile Medical Packaging Developers

Industry Trends and Global Forecasts, 2023-2035 report features an extensive study of the current market landscape, market size and future opportunities associated with the Sterile Medical Packaging market, during the given forecast period. Further, the market report highlights the efforts of several stakeholders engaged in this rapidly emerging segment of the biopharmaceutical industry. Key takeaways of the Sterile Medical Packaging market are briefly discussed below.

The report includes the list of players operating in the global Sterile Medical Packaging market. Some of the key players include:

- Amcor Plc

- Berry Global Inc.

- DuPont de Nemours Inc.

- Sonoco Products Company

- West Pharmaceutical Services Inc.

Sterile Medical Packaging Market: Key Developments

- In March 2024, Greif, a global leader in industrial packaging products and services, has partnered with CDF Corporation to introduce an innovative redesign of its GCUBE intermediate bulk container (IBC) Flex, engineered specifically for transporting highly sensitive and liquid products under sterile conditions.

- In November 2023, Medical packaging manufacturer Coveris is set to launch a new recyclable, flexible thermoforming film solution, called Formpeel P, for use in various medical packaging applications.

Scope of the Report

The market report presents an in-depth analysis of the various firms / organizations that are engaged in this market, across different segments, as defined in the below table:

|

|

Key Report Attributes |

Details |

||

|

|

Base Year |

2023 |

||

|

|

Forecast Period |

2024-2033 |

||

|

|

CAGR (2024-2033) |

10.5% |

||

|

|

Material |

|

||

|

|

Type |

|

||

|

|

Sterilization Method |

|

||

|

|

Application |

|

||

|

|

Key Geographical Regions |

|

||

|

Key Companies Profiled |

|

|

||